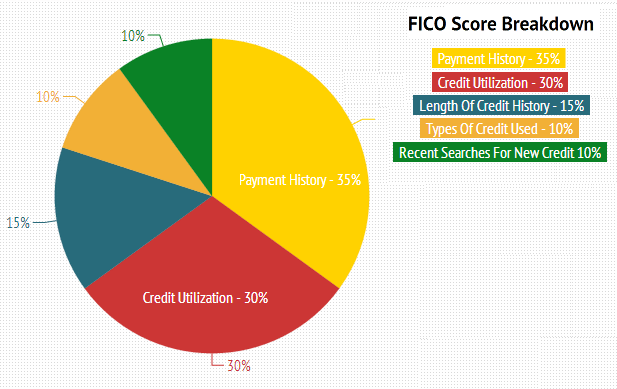

A few factors can impact your credit score. The length of time that you've had accounts with various lenders, the amount of debt you have, and the type of credit you've had are all factors. You can improve your credit score by doing a few things.

Repayment of a loan

You should know that a high credit score could be detrimental to your credit score. Your credit score is affected by many factors including length of credit history, amount owed, and other factors. Your credit score is influenced by the average age of your accounts, which is approximately 15%. Therefore, paying off older balances on loans is bad for your credit. Low balance loans can also lead to lower credit scores.

Credit history length

Having a long credit history helps your credit score. Lenders can use this information for credit decisions. Lenders can determine if you have made timely payments in the past, and if you are trustworthy in the future. Lenders are more likely to lend to someone who has a long credit history, than to someone with one that is relatively new.

The amount of debt

High credit scores can be hindered by excessive debt. High debt does not necessarily indicate high credit risk. If you are able to manage high debt properly, it can have a positive impact on your credit score. According to a recent survey, 36% of respondents said that high debt did not affect their credit scores if they were able to make their payments on time.

Payment history

Credit scores are influenced by your payment record. It reflects whether you make your payments on time, how often you miss them, and how recently you've missed a payment. A good credit score is based on a strong payment history. It's also important to make timely payments on your accounts. It will increase your credit score if at least 90 per cent of your payments are made on time.

Impact of applying for credit on credit score

Multiple credit lines, such as credit cards, can reduce your credit score. This is because multiple applications trigger hard inquiries, which hurt your credit score. It's best that you only apply for one credit card and wait to receive approval. To build credit, you might also consider a personal loan over a credit card.

To improve your credit score, set up automatic payments

One of the best ways to improve your credit score is by setting up automatic payments. This allows you to keep up with your bills, and it also helps you avoid missing any. If you make regular payments, this can help improve your credit score. However, if you miss a few payments, it can have a negative effect on your credit score.