The best credit card for bankruptcy is one that doesn't charge a high annual cost and offers rewards. For example, the Discover it(r), Secured Credit Card is one such card. The card does not have an annual fee, foreign transaction fees, late fees, or a penalty. It also gives you free access to your FICO Score.

OpenSky Secured Visa(r), Credit Card

If you recently filed for bankruptcy and want to rebuild your credit, the OpenSky Secured Visa(r) credit card is a great choice. This card allows for you to make your payments on time and lets you set a credit limit. The APR and annual fees are also lower than other secured credit cards. OpenSky is a Capital Bank secured credit card, which comes with all of the benefits associated with a Visa card.

Another great feature of the OpenSky Secured Visa is that it does not run a credit check. Your credit limit is determined by the amount you deposit to the card's accounts. You can increase this limit at any time. A $35 annual fee will be charged for this card. This card will not upgrade to an unseen account.

Discover it Secured Credit Cards

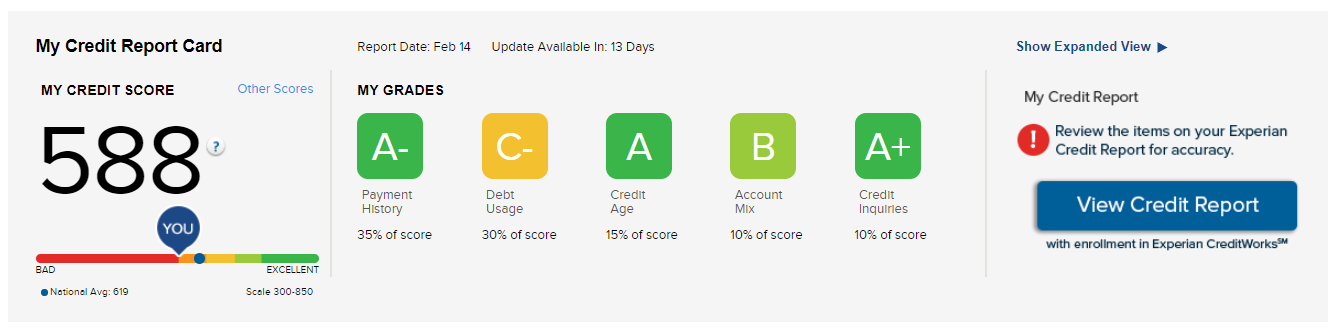

The Discover it secured credit card is the right option for you if you are looking to get your life back on track after bankruptcy. You don't need to pay an annual charge and you can get rewards for each use of your card. This secured credit line does not have foreign transaction fees nor late fees. It also offers free access to your FICO score, which will help you improve your credit score.

Secured credit cards have a higher interest rate than regular credit cards, but they can still be a useful tool for learning credit card habits. The Discover it Secured credit cards can help you get your credit back on track after chapter 13. You'll earn double cashback for all purchases in the first year.

Capital One Platinum Secured Card Credit Card

Capital One Platinum Secured Credit Cards after chapter thirteen are a good option if you have recently filed for Chapter 13 or have a poor credit history. The credit card is free of annual fees and can grow with your needs. The minimum security deposit required is $49 but it can be paid in 35-day installments. Once approved, you can use the card to start rebuilding your credit. After your security deposit has been paid, the company will increase your credit limit by $1,000.

This card is ideal for those looking to build their credit history. You will need to make an initial deposit of $49 or $99, and $200. After that, you can repay it in 30 days in $20 installments. The card does NOT offer rewards or high credit limits, but does provide some benefits, including no foreign transaction charges. Fraud protection and emergency card services are also included, as well as Mastercard ID theft protection.