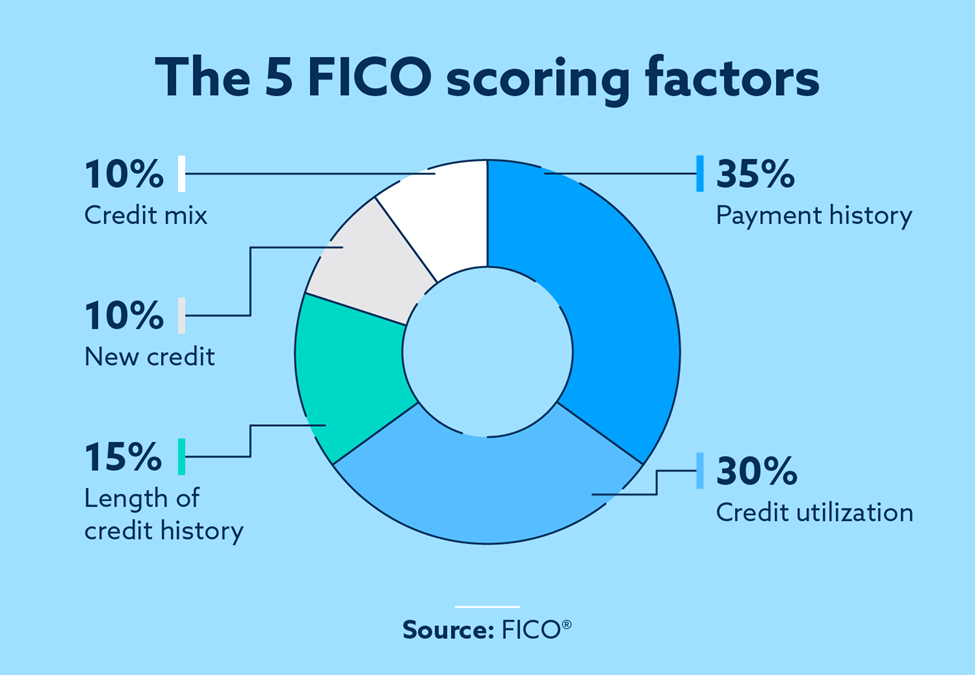

This article will discuss the FICO(r), 9 score and what it means. We will also discuss MyFICO, the other options available for a FICO (r) Score and how rent payments could affect your credit score. Before we get into all the details, let us first talk about the three factors that influence your FICO(r). You will be curious to learn about each one.

FICO(r) Score 9

FICO(r), Scores are a well-known and most commonly used score. They have been around for over 25years. Lenders used FICO(r), score first in 1989. There have been many changes since 1989: consumer demand, data reporting practices, credit-granting requirements. Here's what you need to know about this credit scoring system. And, as always, keep your score in mind!

The FICO(r), 9 Score has seen many changes from its predecessors. Because medical debt is not included in calculating your score anymore, you will likely have a lower score if you receive a bill from a surgeon for the same procedure. Rent payments are a great way to build credit, since collections don’t affect your rental history.

Your credit score is affected by your rental history

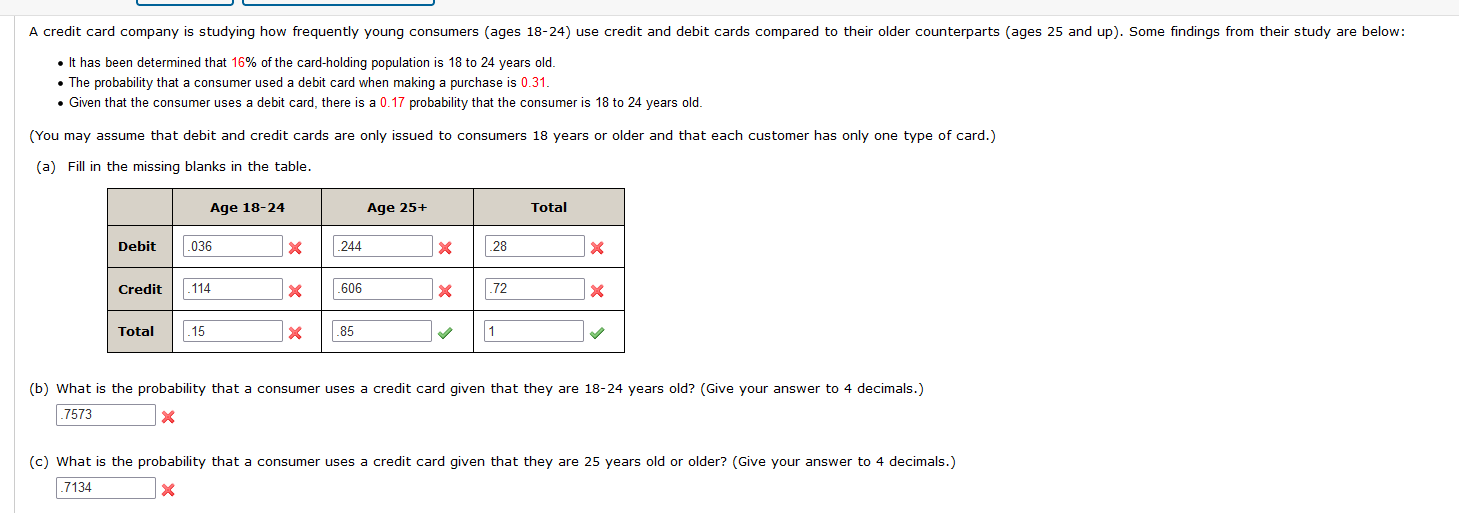

Although you may not believe that rental payments have an impact on your credit score, they can. This information is reported to credit bureaus. Credit scoring models consider whether you've made regular payments on time or missed them. Credit scoring models consider both your rental payment history as well as your credit history. However, there are some important things you should know about this credit reporting data. Read on for more information.

Experian recently found that 75% of participants experienced a rise in credit scores after including rental payments on credit reports. That increase can range from 11 to 29 points. Although it may not seem like much, this will make a significant difference in your credit score. While the immediate impact of this change isn't significant, it can help you improve your credit score. If you're interested in learning more about the impact of your rental payment history on your credit score, read on.

MyFICO

You might be curious about MyFICO score 9, if you have low credit scores. Access it is free and easy to get from your credit card provider, lender or credit counselor. Your score can be affected by a negative credit history. You can however dispute it. The good news is that there are ways to improve your score and keep your interest rates low. Here are some suggestions.

Medical Collections. Unlike previous FICO scores that considered medical debt a significant factor in determining a credit rating, this one is not. According to the Consumer Finance Protection Bureau (CFPB), the impact of medical collections is smaller than for other types. Medical collection accounts should not be ignored. Although medical collections are taken into consideration by the new FICO formula, it is not clear how much. Medical collection accounts are not as significant as other types of collections, so they won't negatively impact your score as much as other types of debts.

Other options for getting a FICO(r) Score

FICO(r) scores have been around for over 30 years. They are simple measures of creditworthiness. FICO(r), 9 was the most recent version. It is more credit-friendly and designed for consumers. It considers things like rental history and payment history. However, it makes them less detrimental. Another options for obtaining a FICO(r), score 9 are debt consolidation loans.

Although FICO(r),9 may seem like an enormous change, there are many things you could do to increase your score. For instance, one option is to make your payments on time. Doing so will raise your FICO score to 25 points. LevelCredit allows you to retrieve up to 24 years of past payments by reporting your payments to TransUnion. It is possible that lenders may not use the same model as you do. Therefore, it might take some time before you receive your FICO score.