One of the fastest ways to build credit is to piggyback on someone else's account. This involves becoming associated to someone else's credit card account, such a parent/employer or sibling. This will raise your overall credit score. This is how you can increase your credit score.

Service for reporting on rent

A rent reporting service reports your rent payments to the three major credit bureaus. While some of these services are available for free, others require you to register with your landlord. In general, it can take up to a full year for your rent history and credit report to reflect this. Before you sign up for a service or product, please review the fee schedule.

It isn't the fastest way of building credit but it is a great way to improve credit ratings. Regular payments can establish a positive credit score, which will make it easier to obtain future loans and mortgages. A rent reporting service can help you avoid mistakes that could harm your credit score.

Secured Credit Cards

If you have been denied credit recently, a secured card could be the best way to start. Secured credit cards allow you to report all your payments to the major credit bureaus. This is crucial as 35% of your FICO score is determined by your payment history. It is possible to quickly improve your credit score by making timely payments to your secured card. To make it easier for you to keep up with your payments, you can sign up to auto-payment.

Secured card issuers don't have to look at your credit score. However, they do take into account your income and other accounts. This helps them gain a better understanding of your finances. This can help them decide whether you're a good risk for them.

Paying your balances on-time

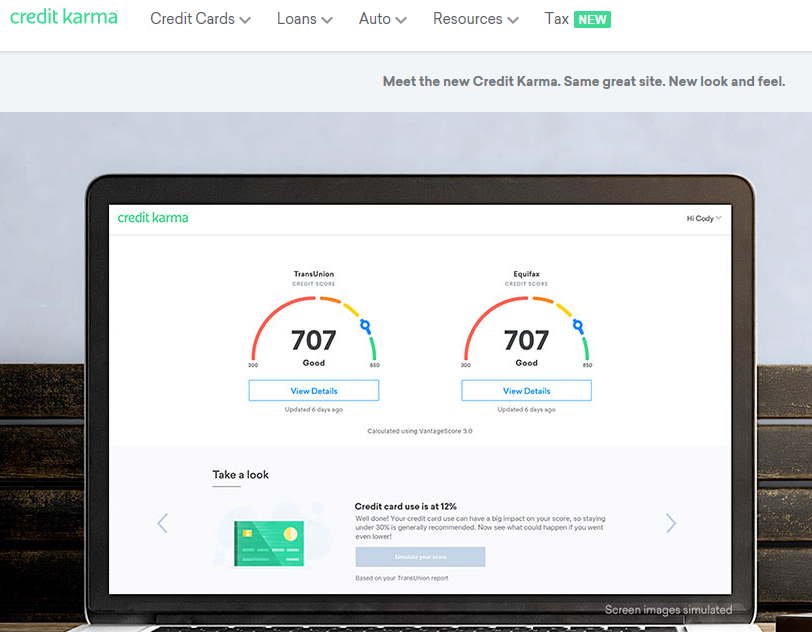

You can improve your credit by paying your monthly bills on time. You will be seen by credit agencies as a responsible borrower. This is important for reducing your total credit utilization ratio, which is the most important step to building credit. Within 6 months, your credit score should start rising.

The difference in credit utilization ratios between the two methods is minimal. You will feel progress if you pay off your balances on a timely basis, especially if you reduce your total credit utilization ratio. Additionally to paying your bills on time, it is important to have an emergency fund with at least three to six monthly expenses.

Experian Boost

Experian Boost helps you build credit in as little time as 10 days. It can be used to increase your credit score or add accounts such as telecom and utility bills to your credit report. This tool can be especially useful for people with poor credit histories or little credit.

The link between your bank and credit card accounts is essential in order for this to work. To link your bank and credit card accounts, you will need an Experian Account. This will allow Experian access to your credit reports and capture any positive payments. It will not report any adverse payments. You must make a minimum of qualifying payments before it can add positive payment activity.

Getting a cosigner

Getting a cosigner for a loan is a great way to improve your credit history. Cosigners will pay the loan and can help you get a lower interest rate. Your cosigner will be equally responsible for the loan, so if you don't make payments, it could affect their credit as well. However, you should avoid purchasing many credit reports, or paying for them for a small fee.

First, make sure you pay your cosigner on time. Once you have a track record of good payments, you can apply to a credit card. You will be able to open one account with a low amount. Pay your card on time and keep the balance below 15% of the card's maximum. If you make timely payments, revolving debt can be a significant part of your credit score.