A secured credit card is a type of credit card in which you must make a refundable deposit in order to use the card. These cards can be used to help you get an unsecured credit card. Secured credit cards require you to make a deposit with the issuer. This means you need to be cautious about your spending. Spending on these cards should be limited to a small number of purchases per month. Also, make sure that you pay your bills on time.

Secured credit cards require a refundable deposit

You can apply for a secured loan card if you have excellent credit history and are prepared to deposit a small amount. A small deposit of $250 can give you greater control over your cash flow than a larger amount. The security deposit is non-refundable and it can be difficult to access in an emergency. If you are unable or unwilling to pay your monthly bills, your card may be cancelled.

If you have poor credit or no credit, secured credit cards can be a great option. These cards don't require you to pass a credit check. However, they might charge higher fees. To get a refund, you will need to provide your bank account information. In certain cases, the issuer might give you a statement card credit for your new unprotected card.

They can be used as a starting point to an unsecured credit card

Upgrading from a secured credit card to one that is unsecured can be done by making periodic payments on your secured card. This will build your credit score to a level that will qualify you for an unsecured credit card from your card issuer. A credit score of 580 or more is the norm. Also, credit utilization should be below 30 percent.

Secured credit card cards are great for building credit and helping to develop good credit habits. But, they don't provide a permanent solution to your credit problems. Many people end up upgrading to an unsecured card.

They are a proof that lenders need good credit history

Secured credit cards are one way to establish credit history. If you are a bankrupt or have a lot of debt, most secured card issuers won't issue you a card. Bankrate's CardMatch tool allows you to verify if your application is eligible.

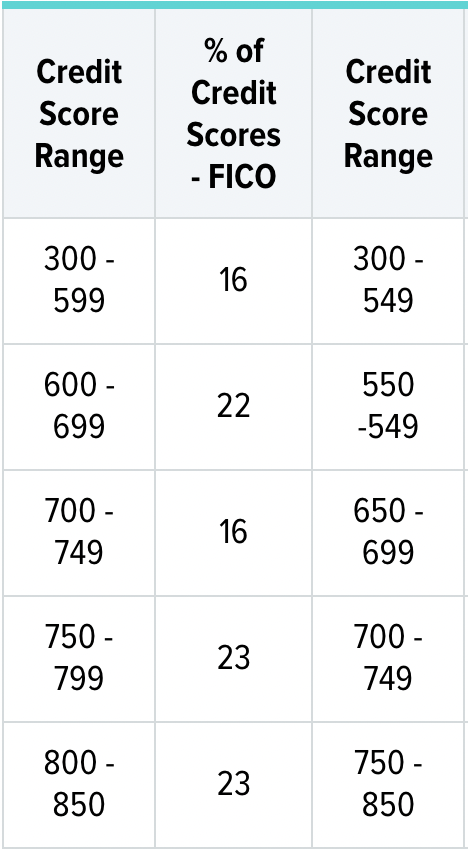

Certain secured credit cards let you automatically increase the credit limit after you have made on-time payments. This will increase your purchasing power as well as raise your credit score. Lenders consider FICO scores of 670 or higher "good".

They are also more accessible than unsecured card

You might consider a secured credit line if you're looking to improve credit. These cards are more accessible than unsecured. The issuer of these cards will require you to make a deposit. This is in order to cover any charges incurred if you fail to pay the bill. These cards are better for people with poor credit as they can help them rebuild their credit history.

Unsecured credit cards are harder to obtain and have a higher risk. You may have trouble getting approved even for a small credit line if you have poor credit. Additionally, you may have to pay high fees that cannot be refunded. You may then end up with an APR higher than your credit score.

They can help build credit

Secured credit cards are an excellent way to get started building your credit history. These cards report monthly information to the credit bureaus and help you build a good history. You can build credit with a secured bank card by paying your bills on time. Keep your account open for as long as possible to build a solid credit history.

You can improve your credit score by getting secured credit cards. However, you need to know how to use them. Remember to make your monthly payments on time and don't spend more than 30% of your credit limit. If you have poor credit and want to rebuild your credit, secure cards may be a good option. They report to the credit bureaus each month and have low annual fees. Some of the best secured credit cards have no annual fees or a minimal deposit requirement.