When looking for personal loans, it is important to read the fine print. Be sure to look for hidden fees or unfavorable terms. It is important to evaluate your financial situation and stay away from companies that could put you in financial difficulties. If you are looking for a loan that will give you the money you need now, it is important to shop around.

Unsecured loans

An unsecured loan may be the best option for you if you're looking to get a personal loan with low APR. Secured loans are secured loans that require the borrower or lender to pledge a collateral asset. They typically have lower interest rates and less risk than unsecured loans. If you default on your payments, you could lose your collateral. So, be aware of the risks and don't forget to research the options before applying.

Earnest, an online lender offering personal unsecured loans for a low price, is an outstanding choice. The company is licensed in 45 states, Washington D.C., as well as Canada. Young people with low credit scores will find it a good choice. You must have a clean credit history, steady income, and a monthly income that is equal to the amount of the loan.

Low interest rates

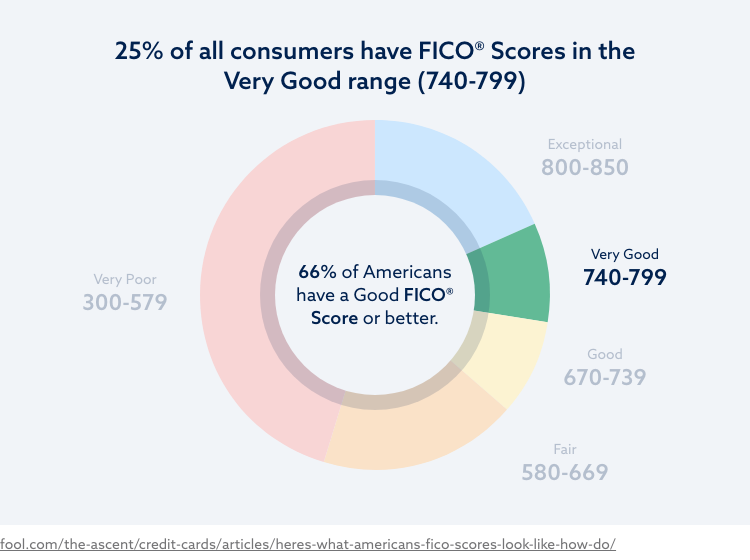

Excellent credit may allow you to get personal loans at low interest rates. This is because you don't have to provide as much documentation as people with lower credit scores. Some lenders don't even require tax returns or pay stubs. An excellent credit rating shows that you have a history of timely repayment.

Personal loan APRs can vary and people with great credit should shop around to get the lowest rate. Rates for borrowers with good credit typically range between 9.99% and 13%. Individuals with good credit may qualify for lower rates. Consider a 0% balance credit card that can be used to transfer your existing credit, which will help you avoid paying interest.

Short-term loans

It is much easier to get a short-term loan than you might imagine. You can apply online for most lenders and you can also use a direct deposit account to pay the loan off. These loans can be the best option for emergencies because the terms are so simple. However, you need to be cautious about predatory lenders.

Specialized credit sources can help you improve your credit score, even if you have bad credit. Personal loans are a great option if you have a need for money that is more urgent than what you can get with your credit card. These loans can be repaid in equal amounts over a set period of time and can last from a few weeks up to many years. The short-term personal loans can be paid off in one lump sum, usually within two to three weeks.

Peer-to-peer loans

A great option for people who have good credit is to apply for peer loans. Online application is possible for all types of loans. Once you have submitted your application, you'll receive a loan amount and the terms. This will help you determine if a peer to peer loan is right.

The process is straightforward. You apply online and most peer-to-peer lending platforms offer pre-qualification tools. These tools will run a credit check and assign a category to your request. Once your loan application is approved, the lender will submit it to their investor platform. Potential investors will be able to view your information and offer funding for your loan. After approval, funds can be received within days.

Online lenders

If you are applying for a personal loans, having excellent credit could be an advantage. You can get better terms and approval rates if you have excellent credit. Before you decide to make a purchase, you should shop around for rates. Each institution has different criteria for approval of borrowers. You can compare quotes from multiple lenders to find a lower rate.

Many online lenders specialize in personal loans for people with good credit. A few of them offer a variety of loans that range from a few hundred to as high as $100,000. Most lenders limit loans to around $50,000. These lenders may also limit their loans to people with a certain amount of income. The interest rates and repayment terms of lenders can vary, but borrowers with outstanding credit can receive the best rates.