After filing for bankruptcy, you might be worried about your ability to regain good credit. Although it might be natural to want new credit lines and to improve your credit score, it is essential to pay off all your existing debts. In bankruptcy counseling programs, you should be able to learn about budgeting as well as ways to reduce your debt. Nonprofit credit counseling agencies such as the National Foundation for Credit Counseling can offer guidance.

Timely payment of bills

Payments on time are a crucial aspect of credit restoration after bankruptcy. Paying your bills on time is crucial to rebuild your credit. Your payment history accounts for 35% of your FICO Score. It's also a good idea not to exceed your monthly budget. By limiting your monthly spending, you can keep on top of your bills and end the cycle of debt.

One of the best ways to rebuild your credit after bankruptcy is to start by paying off any outstanding debt. The next step after you have paid off your debt is to start building an emergency fund. Spend less than you earn, so it is essential to have money saved for unexpected expenses.

Secured Credit Cards

Secured credit cards can be one of your best tools to rebuild your credit following bankruptcy. These cards require a minimum deposit of at least the card's credit limit. This deposit is non-refundable unless the card's status is upgraded or closed. These cards can be a great way to improve your credit score and build a solid credit history.

This card is easy for bankruptcy victims to obtain because the credit limit is equal to the security deposit. Unsecured credit card, however, does not check your credit and can even be extended credit to you despite your bankruptcy. The negatives of these cards are the high fees, punishing interest rates, and high fees.

Using Peer to Peer loans

Lenders are often wary of individuals who have declared bankruptcy. Lenders are often wary of individuals who have declared bankruptcy. This is because they have lost their assets or had to pay off previous loans. You can rebuild your credit with a few simple guidelines. For example, you should be honest about your situation and provide proof that you have improved your financial habits. It is also important to show that you have saved money.

A clean credit report is an essential step in rebuilding credit following bankruptcy. You can get a copy of your credit report from the three major bureaus for free. Next, correct any errors.

Negative information on credit reports can be rectified

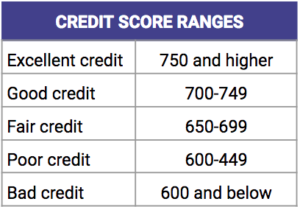

Even though bankruptcy can damage your credit history, it's never too late for you to begin rebuilding it. You can start rebuilding your credit as soon as you file bankruptcy. Even if it seems like you have poor credit, you still can build it back up in just months.

Start by writing to credit reporting agencies disputing inaccurate information. The Fair Credit Reporting Act requires credit bureaus to investigate disputes and correct inaccuracies. Notes explaining your side of the story can be sent to credit bureaus. The information will remain on your credit report for seven years, so it's important to take action right away.

Applying to a new credit-card

A new credit card can be obtained to rebuild credit after bankruptcy. A low utilization rate is a good way to rebuild credit faster, even though credit card companies will have to report all your payments to the credit bureaus. It's best to have a zero balance and pay it off right away.

You must demonstrate that you can manage your money responsibly when rebuilding credit after bankruptcy. Your credit score is largely based on your credit card payment history, so it's important to use credit cards responsibly. While you can use a credit card to pay for things that you can afford to pay off immediately, you shouldn't overextend yourself and run up high APRs.