Have you ever wondered, "Can my bank tell my credit score?" Then you are in luck. The answer is "yes!" It doesn't require a credit score and you don't even want to use a debit card. Your score can be checked as often as you wish. However, these sites may give you scores that are 60 to 70 points higher than the actual score.

TransUnion's VantageScore

A credit score represents your credit history numerically. Your score is based on several factors, including payment history and the total number of accounts you have. Your score is affected by the age of each account. It is also important to consider your mix of accounts. Your score is 11% based on the total balances in your accounts.

No matter where your credit score comes from, you can still dispute errors which affect your score. Credit repair services exist that can help you correct any errors. VantageScore has been growing in popularity and is now a viable option to FICO scores.

FICO's FICO

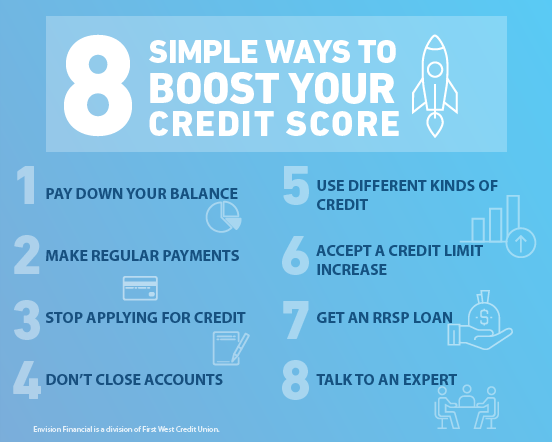

The factors that impact your credit score are numerous. The majority of your credit score is determined based on your payment history and how much money you owe. The Fair Isaac Corporation created a mathematical formula in 1958 to calculate the FICO score. The rule of thumb is that the better your credit score, generally speaking, the more you earn. Your credit score will improve if you pay off your outstanding debts and keep your credit limit at a reasonable level.

Most banks have credit scores calculators and can provide you with the result. The bank can also provide information about the credit score it prefers. FICO scores play a major role in lending decisions.

Experian's VantageScore

Experian's VantageScore credit score is available. It is based both on your credit history (and the current balances on your accounts). Your credit score is an important part of obtaining a loan. Your credit score will drop if you owe more money than you can repay. But, paying off your debts is a good way to improve your score.

VantageScore's credit score is calculated using information from your credit reports. This includes information from lenders about whether you have paid on time. However, not all financial institutions report to all three credit bureaus. You may have a different credit score from each bureau.

VantageScore is a VantageScore product by VantageScore

You might be worried about credit scores. The best way to do this is to manage your finances responsibly. It is important to pay your bills on time. Setting up reminders or automatic payments can help you keep on track. If you're going to be late on any payments, let your lender know. This will help them not report your payment to the credit bureaus.

Your payment history including late payments or collections is the basis for your credit score. It also considers the age and type of your credit accounts. Credit scores below 700 are not recommended as you should avoid too many balances.

Equifax VantageScore

You may be asking yourself: "What's my credit score?" Equifax's VantageScore will help you figure this out, which is good news! The VantageScore takes six factors into account, including your payment history. The VantageScore is also based on your total credit available, age of credit history and types of accounts. Late or missed payments can negatively affect your score.

A lender may ask about your credit history, including inquiries and new accounts, when you apply for a mortgage. This is because creditors want to see your financial history and that you only take out credit when necessary.