SunTrust offers several features to help improve your credit score. These features include a $300 minimum deposit, no annual fees and zero penalty APR for late payments. You can also earn cash back rewards with the card. It offers all the benefits you would expect from a credit-card.

$300 minimum deposit

The SunTrust Secured Credit Card requires a minimum deposit of $300 to open an account. The amount required to open an account with SunTrust Secured Credit Card is $300 minimum. This amount can change depending on your credit rating. You can deposit the money into a secured savings account, where it earns interest while using your credit card. Your deposit will be returned once your account is in good standing. This card also has the great advantage of being able to be upgraded to an unprotected card if you have a good credit rating.

A minimum deposit of $300 is not outrageous, but it can be a pain in the neck, especially if you're living paycheck to paycheck. Even though a small amount might seem reasonable to you, credit scores are dependent on your credit usage. Penalties will be applied to credit cards that use more than 30% your available credit.

Late payments do not incur a penalty APR

The Suntrust Secured Credit Card with Cash Rewards comes with a low annual fee and no penalty APR for late payments. In order to qualify for the card, applicants must deposit a minimum of $300 in a special savings account. The money earns interest while it is open and will be returned to the applicant once the account is closed. The initial deposit amount, which can be as high as $5,000, determines the credit limit of the card.

SunTrust Secured Credit Card comes with a rewards structure very similar to that of its sister card, SunTrust cash Rewards Credit Card. The card pays 2% cashback on your first $6,000 in gas purchases, and 1% cashback on all other purchases. However, this card is not suitable for people who have recently filed for bankruptcy.

No annual fee

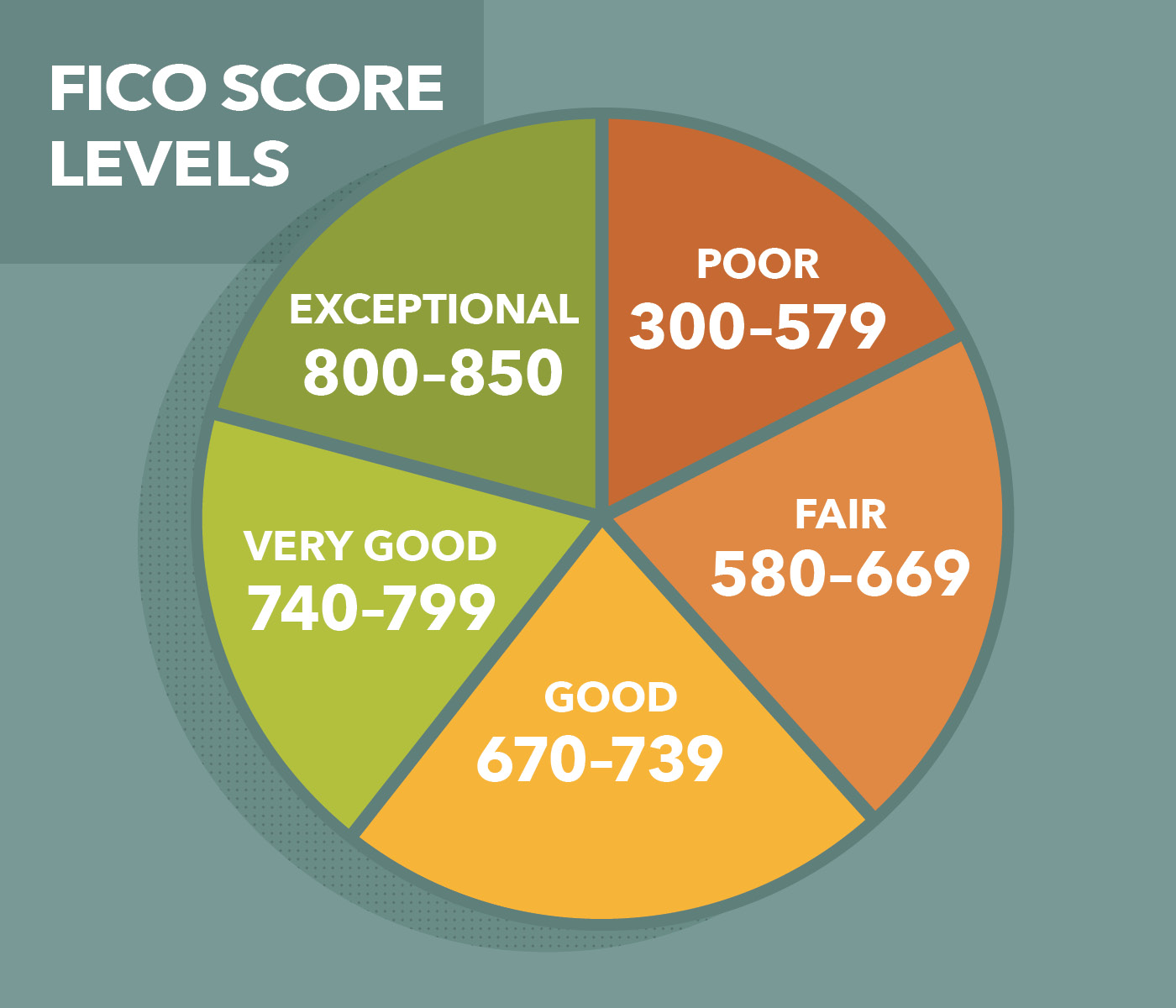

SunTrust Secured Credit Card is free of annual fees and can be a great option for people with bad credit or those who are trying to improve it. It requires a small deposit of $300 and is backed by a savings account with the bank. Each month, the card reports directly to all three major credit reporting agencies. You can also get a free FICO score. Access your score online, or through the bank's mobile apps, is also possible. The card also offers rewards that can be used to purchase merchandise or services.

SunTrust Secured credit card with cash rewards allows you to earn as much as 2% cashback on all your purchases. You also get purchase assurance and FICO credit score access each month. Additional benefits include a free replacement card for lost or stolen cards and the ability freeze your account.

Cash back incentives

Suntrust offers a range of credit cards with cashback rewards. Platinum Mastercard has a 1% cash back reward, free annual fees and no foreign transaction fees. It also offers 2% cashback at petrol stations and 1% back on everything else. You can also spend as much as $6,000 per annum without having to pay interest.

SunTrust Secured Credit Card offers cash rewards and can help you build credit. This card will help improve your credit score by reporting your payment history to major consumer credit bureaus. SunTrust Secured Card gives you up to 2% cashback for qualifying purchases.