The surge Mastercard is a unsecured credit card designed for people who have fair or bad credit. This card sends information to the major credit bureaus.

If your credit is poor, you may have difficulty getting a credit cards. Many people with poor or low credit ratings are limited to secured card options that require large security deposits.

However, there are other unsecured cards for credit-building that can help you boost your score without the need to deposit money upfront. Surge Mastercard, a credit card from Celtic Bank, is an example of this type.

With this card, you can double your credit line if you practice responsible credit habits and keep your account open for six months. A monthly credit report is sent to the three major credit bureaus and you get an automatic account review by the card issuer.

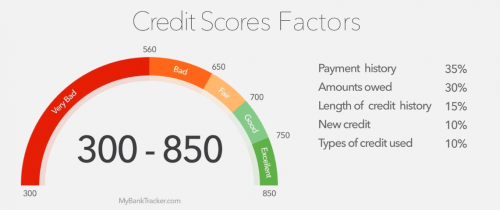

These features will help you build a credit history and improve your credit score, which are essential for getting approved for car loans, mortgages and other forms of credit. It can also help you lower your interest rates and avoid debt in the future.

You can also check to see if you're pre-qualified for this card before applying. This will help you to get an estimate of your borrowing capacity and the speed at which you can increase it.

The Surge Mastercard is one of the few unsecured cards that are easy to qualify for and offer relatively high approval probabilities. The application is easy to complete online.

Some of the advantages of this card include a higher credit limit than most other unsecured credit cards and a no-security-deposit policy. These benefits are great for those with fair or poor credit who have difficulty qualifying for other unsecured cards.

It offers a reduced annual fee as well as no monthly maintenance charges. It will help you improve your score and save money on purchases.

Another benefit of this card is that it will help you raise your credit limit, boosting your available credit and giving you more purchasing power. The credit limit on this card ranges from $300 to $1000, depending on the credit history you have and your current credit usage.

The card also reports your on time payments to all the major credit bureaus. These reports will help you increase the credit limit on your card and be approved for additional credit in the future.

Surge Mastercard could be a good option for you if you want to build your credit rating and improve your credit score.

Surge Platinum Mastercard can be used to build credit. This card does not offer rewards, but has a very attractive APR. It also comes with a low annual charge.

Surge Mastercard should be part of a comprehensive credit building strategy and not your sole credit card. It will help you to build your credit as well as earn rewards.